Apple Inc (AAPL)

Apple Inc engages in the design, manufacture, and sale of smartphones, personal computers, tablets, wearables and accessories, and other variety of related services. Its products and services include iPhone, Mac, iPad, AirPods, Apple TV, Apple Watch, Beats products, Apple Care, iCloud, digital content stores, streaming, and licensing services. AAPL crossed the 1 trillion dollar market capitalization mark on 2 Aug 2018. AAPL is a component stock of the S&P 500, Nasdaq 100 & DJIA index.

Stock Valuation

Price /Earning | 40.71X. Not cheap at all. Vs average PE of S&P 29.46X & Nasdaq 27.26X.

Price /Book | 10.74X. Expensive. Vs average PB of S&P 3.87X & Nasdaq 3.72X.

Dividend Yield | 0.68%. Very low. Vs average DY of S&P 1.74% & Nasdaq 1.45%.

Net Income | USD 13.14B 20Q2 (+10% YoY)

Cash & Equivalents | USD 93.05B (-1.9% YoY)

LT Debt | USD 94.05B (+10.7% YoY)

Analyst Consensus

Target Price USD 146

Call | Buy /Overweight.

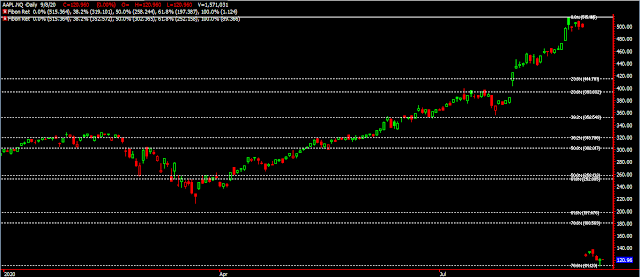

Technical Analysis

Uptrend. Support USD 89, resistance USD 180.

Conclusion

AAPL traded split adjusted on 31 Aug (4 for 1 split, ie, 1 existing shares becomes 4 shares). A stock split has no economic implications or bearing on the value of the stock.

AAPL reported on 31 Jul EPS of USD 2.58 beating estimate by USD 0.55. It's ROE is 70% & net margin is 21%. Solid quarterly result couple with the highly anticipated September launch of the 5G phone caused the surge in AAPL price recently.

Valuation wise not cheap. But more "affordable" price & business potential can be a catalyst for more upside. AAPL has calmed down a bit post-split, can look into buying again.

No comments:

Post a Comment